| Home |

2017-11-21 by Budgeter

Let's ask a couple of difficult questions before emptying the savings account to make a purchase

And between investment and speculation?

To make it clear from the beginning: I am not against a concept of cryptocurrencies. I find it very interesting, both professionally, as well as sociologically. It's just there can be no or little connection between studying interesting concept and spending my retirement savings on a computer file.

I am a software developer with 20 years worth experience in payment systems. And yet it took me quite a while to understand the concept. And, there are hundreds of small details hidden in the design, different for every cryptocurrency, so it still looks complicated to me.

The number of cryptocurrencies available over the internet as of 6 November 2017 was over 1172 and growing. A new cryptocurrency can be created at any time. Yep – out of thin air.

Hardly a week passes without discovering some cryptocurrency's new bug, design flaw or theft.

The old wisdom tells us that if a taxi driver recommends us an investment, it's time to sell.

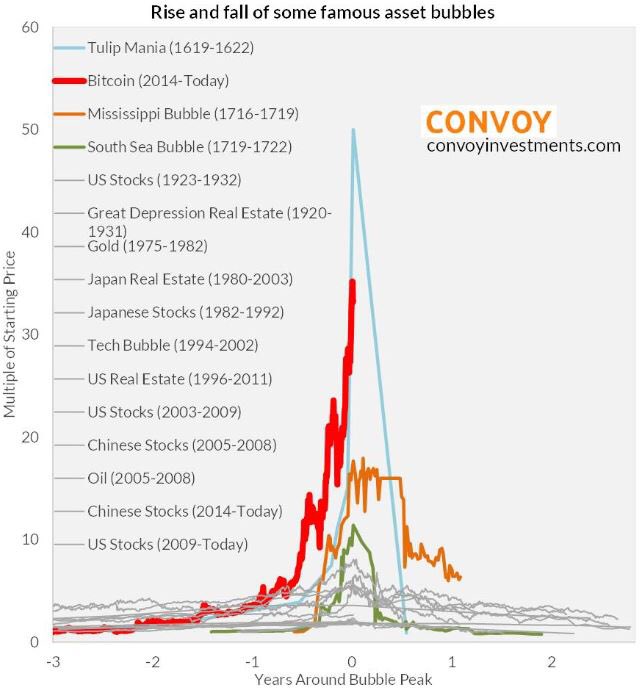

The picture that is worth a thousand words:

Mysterious Satoshi Nakamoto published his paper in which he proposed an electronic cash for payments so small, that it would be impractical to employ fullblown counterparty vetting. How far the reality went from that idea: because the Bitcoin supply is so slow, and so detached from demand, instead of spending it, people started treating it as an speculative asset. Nobody wants to actually use it for paying for stuff and I can't blame them, if the cash itself is in much shorter supply than the hottest London properties.

Everyone understands that it's supposed to kick central bankers' asses and choose something akin to real gold. However it seems like supply needs to be more synchronized with demand to make a currency usable.

More than one in three of us regularily lose priceless family digital pictures. With traditional bank account, as naughty as they are, banks would still grant you acces to your money, even if you lose everything in a fire or flood. It's enrtirely up to you though to take care of your private key.

Of course, you can trust somebody to keep the wallet for you. Mt. Gox anyone?

... which leads us to the next point:

Especially recently, in a QEs era, we got used to thinking that financial authority is all evil. But is it? Do you really like the idea of not being able to recover any of the stolen funds? No chance of recovery, no chance for even chasing the thieves?

As it turns out, it's not that straightforward to convert bitcoin to cash. It's a long and bothersome process. Banks easily get suspicious and may even refuse to participate.

Bitcoin, or more generally cryptocurrency, is a very interesting, if not fascinating idea. For now however, to me it remains in its infancy. I know a couple of big banks explore blockchain technology. I can imagine they may create something like private digital currency to make settlements between big market participants easier. Meanwhile though, I very much doubt it will be directly linked to current bitcoin wallets. Betting on bitcoin ride to $100,000 is not far from buying national lottery tickets, except the latter is already much cheaper.